Cosmetic Chemicals Strategic Market Insights on Innovation, Sustainability and Regulatory Compliance

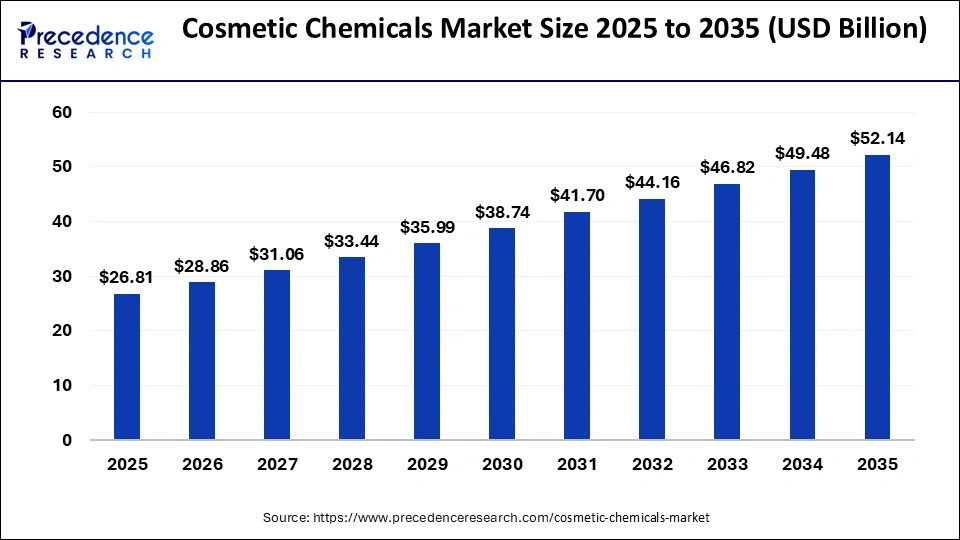

According to Precedence Research, The global cosmetic chemicals market was valued at USD 24.91 billion in 2023. The market demand is anticipated to grow from USD 26.81 billion in 2024 to USD 41.7 billion by 2030, exhibiting a CAGR of 7.64% during the forecast period.

Ottawa, Feb. 05, 2026 (GLOBE NEWSWIRE) -- The cosmetics chemical market continues to grow as global demand for cosmetic products rises. According to data provided by Precedence Research, regulatory bodies such as the FDA and ECHA play a pivotal role in ensuring ingredient safety, thus maintaining consumer trust and market integrity.

The cosmetic chemicals market is the industry that manufactures and supplies chemicals used to develop cosmetics and personal care products. Preservatives, emollients, surfactants, colorants, and perfumes are some substances produced by the market. It is an essential component of the beauty and personal care industry's ability to supply a wide range of cutting-edge cosmetic products.

Invest in Our Premium Strategic Solution: https://www.precedenceresearch.com/request-consultation/19

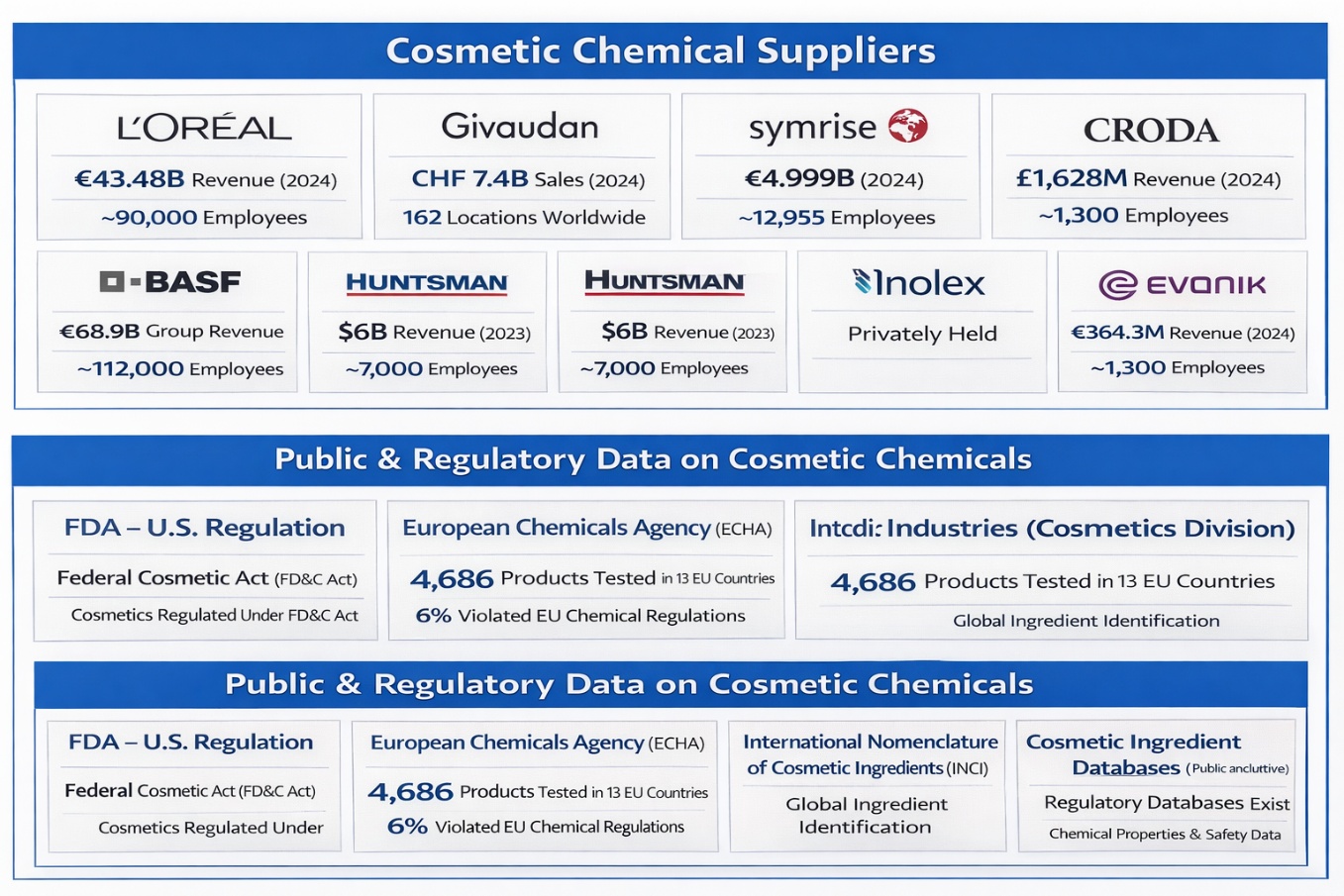

Major Suppliers in the Cosmetic Chemical Market

Several global chemical suppliers specialize in the production of ingredients used in cosmetic formulations. These ingredients range from fragrances to active ingredients that target specific skin and hair concerns. Below are some of the leading players in this market:

1. L'Oréal

- Revenue: €43.48B (2024)

- Operating Income: €8.68B

- Net Income: €6.40B

- Employees: 90,000

- Cosmetic Chemicals Focus: L'Oréal is both a major producer of cosmetic products and a significant purchaser of key cosmetic chemicals. The company sources essential ingredients like surfactants, emulsifiers, preservatives, and UV filters. L'Oréal's demand drives substantial volumes of cosmetic chemical innovation, supporting product lines across skincare, haircare, and makeup.

- Impact: L'Oréal's global scale enables it to influence the development and use of cosmetic chemicals, making it a key player in setting industry standards.

2. Givaudan

- Revenue: CHF 7.4B (2024)

- Cosmetic Chemicals Focus: Specializes in fragrances and active cosmetic ingredients, providing raw materials to global beauty brands.

- Operational Stats: Operates 162 locations worldwide, serving the personal care and beauty markets.

- Impact: Givaudan’s products are a key component in fragrance formulations and cosmetic actives used by major beauty brands. Its vast global footprint allows it to deliver innovative solutions to meet the growing demands of the beauty industry.

3. Symrise

- Revenue: €4.999B (2024)

- Operating Income: €718M

- Net Income: €478M

- Employees: 12,955

- Cosmetic Chemicals Focus: Symrise is a major supplier of fragrances and aroma chemicals, in addition to providing active ingredients used in cosmetics.

- Impact: As a global player, Symrise supplies critical ingredients that go into a variety of beauty and personal care products, helping shape industry trends and innovations.

4. Croda International

- Revenue: £1,628.1M (2024)

- Operating Income: £279.7M

- Net Income: £159.6M

- Cosmetic Chemicals Focus: Croda produces specialty ingredients including surfactants, emulsifiers, and actives that are used in lotions, creams, conditioners, and advanced performance formulations.

- Impact: Croda’s diverse portfolio of high-quality cosmetic ingredients is crucial for the development of skincare and haircare products. Its commitment to sustainability further strengthens its market presence.

5. BASF SE

- Group Revenue: €68.902B (2023)

- Operating Income: ~€2.24B

- Employees: ~112,000

- Cosmetic Chemicals Focus: BASF's Care Chemicals division supplies emollients, polymers, UV filters, and other cosmetic actives used in skincare and haircare formulations.

- Impact: BASF’s scale allows for significant production of cosmetic chemicals. The company’s capacity expansion and volume growth in cosmetic emollients cater to a broad range of global skincare needs.

6. Huntsman Corporation

- Revenue: ~$6B (2023)

- Employees: ~7,000

- Cosmetic Chemicals Focus: Huntsman produces chemical intermediates and additives used in personal care and cosmetics.

- Impact: With a strong global presence, Huntsman’s products support a variety of cosmetic formulations, providing vital ingredients for skin and haircare products.

7. Inolex

- Privately Held

- Cosmetic Chemicals Focus: Inolex supplies sustainable and performance-driven ingredients for cosmetics, including sunscreen components, conditioners, and silicone alternatives.

- Impact: Inolex focuses on sustainable innovation in the cosmetics sector, addressing the growing demand for eco-friendly and high-performance ingredients.

8. Laboratoires Expanscience

- Revenue: €364.3M (2024)

- Employees: ~1,299

- Cosmetic Chemicals Focus: Specializes in dermocosmetics and active cosmetic ingredients like those used in the Mustela product line.

- Impact: Laboratoires Expanscience provides dermatology-grade ingredients, addressing both skincare concerns and specific skin conditions with scientifically backed formulations.

9. Evonik Industries (Cosmetics Division)

- Revenue: Not separately published; part of larger specialty chemicals revenue.

- Cosmetic Chemicals Focus: Evonik focuses on providing specialty cosmetic actives like amino acids and ceramides.

- Impact: Evonik’s dedication to active solutions helps advance formulations that target specific skin and hair concerns, supporting the growing demand for personalized skincare.

Regulatory Landscape for Cosmetic Chemicals

The cosmetic chemical market is heavily regulated, with governments ensuring that ingredients are safe for consumers. Below are some key regulatory insights:

| Regulatory Body | Data / Figures | Context / Regulation |

| FDA (U.S.) | Cosmetics regulated under the Federal Food, Drug, and Cosmetic Act (FD&C Act) | The FDA monitors cosmetic ingredient safety through post-market surveillance. |

| European Chemicals Agency (ECHA) | 4,686 products tested across 345 companies; 6% violated EU regulations | ECHA enforces REACH restrictions to eliminate harmful substances in cosmetic products. |

| INCI (International Nomenclature) | Standardized names for cosmetic ingredients must be labeled on products. | Ensures consistency and transparency in the labeling of cosmetic ingredients globally. |

Key Regulatory Highlights:

- FDA: Cosmetics do not require pre-market approval, except for color additives. However, the FDA monitors safety through post-market surveillance.

- ECHA (EU): Actively tests cosmetic products for compliance with chemical safety limits. The agency ensures that cosmetic formulations meet strict regulatory standards.

-

INCI: Mandates that cosmetic ingredients be listed on product labels with standardized names, ensuring global consistency.

The global cosmetic chemicals market size is valued at USD 26.81 billion in 2025 and is predicted to increase from USD 28.86 billion in 2026 to approximately USD 52.14 billion by 2035, expanding at a CAGR of 6.88% from 2026 to 2035.

The cosmetic chemicals market is evolving rapidly with growing demand for specialized ingredients in skincare, haircare, and other personal care products. Major suppliers like L'Oréal, Givaudan, and BASF are not only the backbone of this industry but also help drive innovation in ingredient development. Regulatory bodies continue to play a key role in ensuring the safety and compliance of these chemicals, giving consumers confidence in the products they use daily. The industry's future growth is likely to be shaped by continued innovation in sustainable ingredients and increasing consumer demand for safer, more effective formulations.

Request Research Report Built Around Your Goals: sales@precedenceresearch.com

About Us: Precedence Research

Our Legacy: Rooted in Research, Focused on the Future

Looking for research that drives real results? Precedence Research delivers strategic, actionable insights, not just data and charts. Based in Canada and India, our team specializes in customized market analysis, executive-level consulting, and tailored research solutions that go beyond traditional survey methodologies to support business growth with precision and confidence.

Insight-Driven

We turn complex data into clear, strategic insights that power confident business decisions.

Innovation-Led

We continuously refine our methods to stay ahead of trends and emerging market forces.

Industry-Agnostic

From tech to healthcare, we serve clients across sectors with tailored, actionable intelligence.

Customer-Centric, Future-Focused, Result-Oriented

We work as strategic partners, engaging deeply with clients to co-create impactful solutions.

Our Commitment: Delivering Intelligence That Drives Transformational Growth

What do we do? We turn data noise into clarity. Through sharp research, agile thinking, and tech-enabled tools, we fuel brands, disrupt markets, and lead with insight that drives unstoppable growth.

Contact Us

USA: +1 8044 419344

APAC: +61 4859 81310 or +91 87933 22019 or +6531051271

Europe: +44 7383 092 044

Email: sales@precedenceresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.